The Main Principles Of Matthew J. Previte Cpa Pc

Table of ContentsMatthew J. Previte Cpa Pc for BeginnersUnknown Facts About Matthew J. Previte Cpa PcGetting The Matthew J. Previte Cpa Pc To WorkFascination About Matthew J. Previte Cpa PcThe Definitive Guide to Matthew J. Previte Cpa PcSome Ideas on Matthew J. Previte Cpa Pc You Need To Know

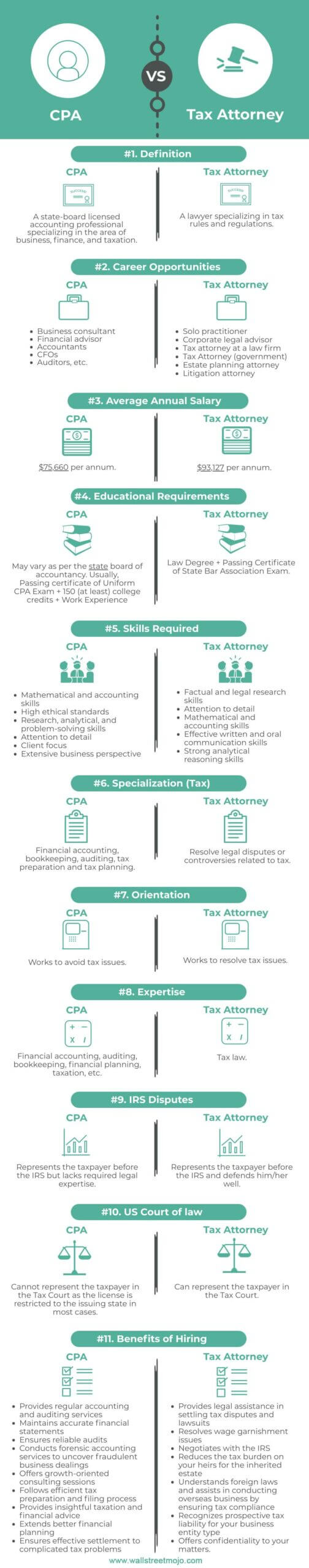

Tax obligation regulations and codes, whether at the state or government level, are as well made complex for a lot of laypeople and they transform frequently for lots of tax obligation professionals to stay on par with. Whether you just need somebody to aid you with your business income tax obligations or you have been billed with tax obligation fraud, work with a tax obligation lawyer to assist you out.

Facts About Matthew J. Previte Cpa Pc Revealed

Everybody else not just disapproval managing taxes, yet they can be outright worried of the tax agencies, not without factor. There are a couple of inquiries that are always on the minds of those who are taking care of tax issues, consisting of whether to hire a tax attorney or a CERTIFIED PUBLIC ACCOUNTANT, when to hire a tax obligation lawyer, and We want to help answer those questions below, so you recognize what to do if you locate on your own in a "taxing" circumstance.

A lawyer can represent clients prior to the IRS for audits, collections and appeals but so can a CPA. The huge distinction right here and one you require to bear in mind is that a tax obligation lawyer can supply attorney-client privilege, indicating your tax obligation lawyer is excluded from being obliged to indicate versus you in a law court.

The Basic Principles Of Matthew J. Previte Cpa Pc

Or else, a CPA can indicate versus you also while benefiting you. Tax obligation lawyers are more acquainted with the different tax negotiation programs than a lot of CPAs and recognize how to pick the most effective program for your situation and just how to get you qualified for that program. If you are having a trouble with the IRS or just concerns and worries, you require to hire a tax lawyer.

Tax Court Are under investigation for tax fraud or tax evasion Are under criminal investigation by the IRS An additional crucial time to work with a tax lawyer is when you obtain an audit notification from the IRS - IRS Seizures in Framingham, Massachusetts. https://www.tripadvisor.com/Profile/taxproblemsrus1. An attorney can interact with the IRS on your behalf, be present during audits, help negotiate settlements, and keep you from paying too much as an outcome of the audit

Part of a tax lawyer's responsibility is to maintain up with it, so you are safeguarded. Ask around for a knowledgeable tax attorney and inspect the net for client/customer reviews.

Facts About Matthew J. Previte Cpa Pc Revealed

The tax obligation lawyer you desire has all of the best qualifications and endorsements. Every one of your questions have been responded to. Unfiled Tax Returns in Framingham, Massachusetts. Should you employ this tax lawyer? If you can afford the costs, can concur to the sort of possible service provided, and have self-confidence in the tax obligation attorney's capacity to aid you, then yes.

The choice to work with an internal revenue service lawyer is one that should not be taken lightly. Attorneys can be incredibly cost-prohibitive and complicate matters unnecessarily when they can be fixed fairly conveniently. In basic, I am a large proponent of self-help legal remedies, specifically provided the variety of informational material that can be located online (including much of what I have published on the subject of tax).

Indicators on Matthew J. Previte Cpa Pc You Need To Know

Here is a fast checklist of the matters that I think that an internal revenue service attorney ought to be worked with for. Allow us be completely truthful momentarily. Criminal fees and criminal investigations can damage lives and carry really severe consequences. Any person that has hung out behind bars can load you know the facts of prison life, yet criminal fees often have a a lot more punitive impact that many individuals fall short to consider.

Wrongdoer costs can likewise carry extra civil penalties (well beyond what is normal for civil tax issues). These are just some instances of the damage that also just a criminal cost can bring (whether or not a successful sentence is inevitably gotten). My point is that when anything potentially criminal emerges, even if you are just a possible witness to the issue, you require an experienced internal revenue service lawyer to represent your passions versus the prosecuting agency.

Some may cut short of nothing to get a sentence. This is one circumstances where you constantly require an internal revenue service lawyer watching your back. There are many parts of an IRS attorney's job that are seemingly routine. A lot of collection issues are taken care of in roughly the same means (despite the fact that each taxpayer's scenarios and objectives are different).

The Matthew J. Previte Cpa Pc Diaries

Where we make our red stripes though gets on technological tax issues, which placed our full ability to the test. What is a technological tax issue? IRS Collection Appeals in Framingham That is a challenging question to address, but the most effective way I would define it are matters that call for the specialist judgment of an internal revenue service lawyer to fix effectively.

Anything that has this "truth reliance" as I would call it, you are going to wish to generate a lawyer to consult with - IRS Seizures in Framingham, Massachusetts. Also if you do not preserve the solutions of that lawyer, an expert viewpoint when taking care of technical tax issues can go a lengthy means towards comprehending issues and settling them in a suitable way